What Are Auto Insurance ID Cards?

An auto insurance card is a visual record of your current auto insurance policy, a compact yet essential representation of your coverage. Your insurance company provides this card to confirm that you have the necessary insurance to drive and operate your vehicle legally. The primary purpose of the auto insurance card is to quickly verify your coverage in various situations — whether during a routine traffic stop, after an accident, or when registering your car.

This card is compact, in contrast to the insurance declaration page. The declaration page is used to review your coverage's specifics, ensuring all information is accurate and meets your needs. It is often required when filing a claim, obtaining a loan against the vehicle, or providing proof of coverage details to a third party, like a mortgagee or lienholder.

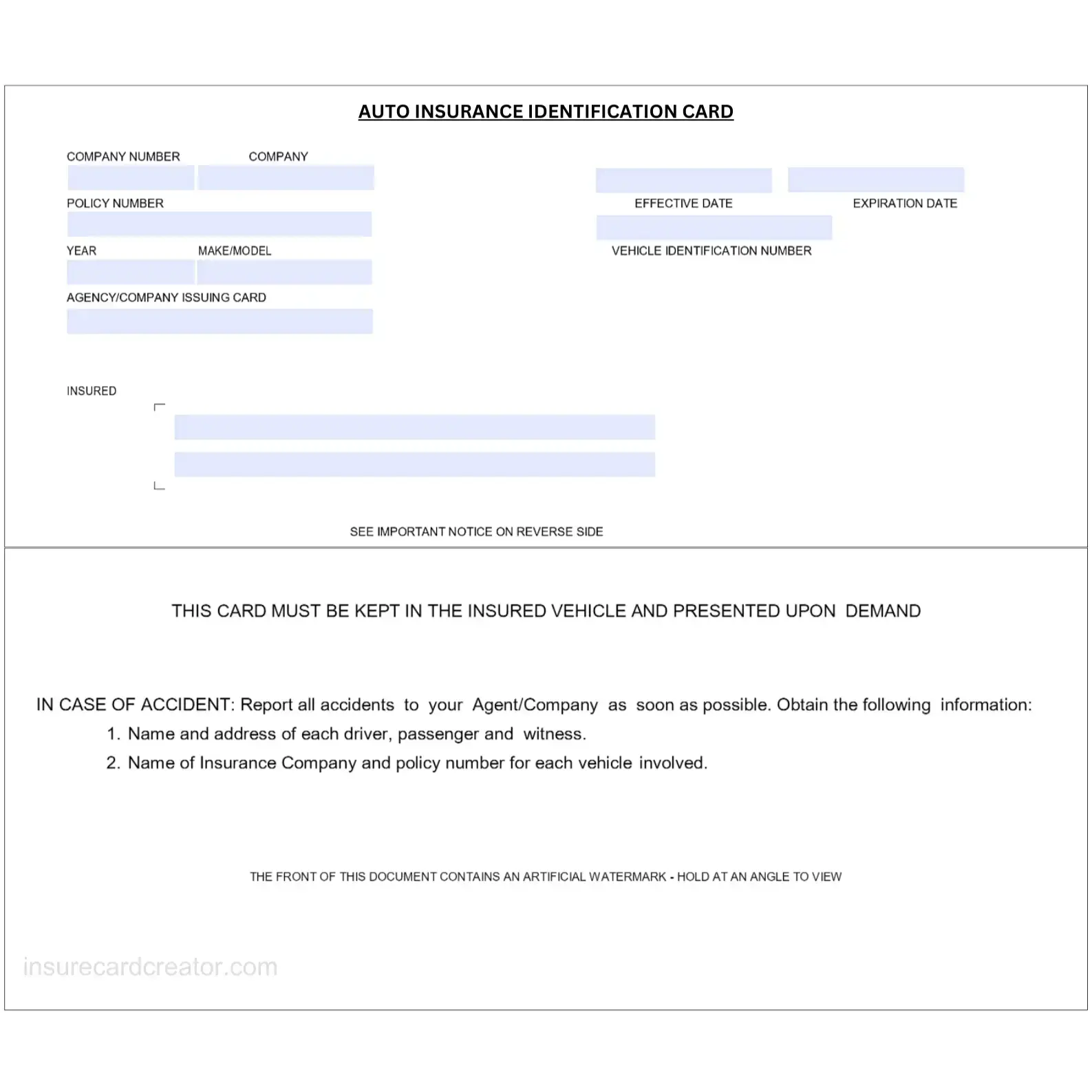

The information typically displayed on an auto insurance card is designed to give you instant access to essential details about your policy:

- The policy number is a unique identifier for your insurance policy. It is critical to reference your specific coverage details with your insurance provider.

- The next field includes details such as the make, model, year, and often the Vehicle Identification Number (VIN) of the insured vehicle are included. It ensures that coverage is linked directly to the specific motor vehicle.

- Policy effective dates indicate the validity period of the insurance coverage, showing both the start date and the expiration date. Confirming that the policy is active is essential.

- The insurance company's contact information, including the name, contact number, and sometimes the address, allows for easy communication with the insurance agent for any questions or necessary claims processing.

- The policyholder's name section shows who holds the policy, which can be crucial in verifying that the driver or vehicle owner is insured.

This insurance ID card, often the size of a standard credit card for ease of carrying, is designed to be kept with you or in your vehicle, ensuring you can present it whenever proof of insurance is required. By consolidating crucial information in a compact format, the auto insurance card provides peace of mind, proving that you meet legal requirements and are prepared for the unexpected.

When to Carry Your Car Insurance Card?

Carrying your car insurance card is fundamental to driving and automobile ownership. It is essential for several scenarios that may arise in your daily life or during unexpected events. Here are key moments when having your car insurance card at hand is crucial.

1. Driving Your Vehicle

It's vital to have your insurance card with you whenever you drive. Many states and countries require drivers to carry proof of insurance in their cars. It ensures that if you're stopped by law enforcement for any reason, you can provide immediate proof of insurance, avoiding potential fines or penalties for failing to do so.

2. After an Accident

If you're involved in an accident, whether a minor fender bender or a more serious collision, having your insurance card accessible allows you to quickly exchange insurance information with the other parties involved. This is crucial in reporting the accident to your insurance company and initiating a claim.

3. Car Registration and Renewal

When registering new motor vehicles or renewing your vehicle's registration, most states require proof of insurance as part of the process. Having your insurance card ready can streamline these procedures, ensuring you comply with local regulations immediately.

4. When Renting a Vehicle

If you're renting a car, the rental company may require proof of your auto insurance coverage to confirm your vehicle will be covered under your policy. Your insurance card provides this proof, potentially saving you from purchasing additional coverage from the rental company.

5. Carrying Out a Traffic Stop or Roadside Check

During a traffic stop or a roadside check by law enforcement, officers will typically ask for your license, registration, and proof of insurance. Presenting your insurance card promptly helps ensure the stop goes smoothly and quickly.

6. Vehicle Inspections

Some states require periodic vehicle inspections, which may include verifying that your vehicle is adequately insured. Having your insurance card with you during these inspections can facilitate a hassle-free process.

The Benefits of Using Auto Insurance Template Card

Using an auto insurance card template offers several benefits, including streamlining the process of maintaining and displaying important insurance information. Whether you're an individual driver, a family with multiple vehicles, or a business with a fleet, these templates can significantly improve your organization and preparedness for any situation.

First, a well-designed auto progressive insurance card ensures that all necessary information is presented clearly and consistently. The uniformity of the template helps quickly locate specific details, such as the policy number or effective dates, especially during stressful situations like traffic stops or after an accident.

You can save a filled template on a smartphone or other digital devices. This digital card offers the convenience of having your insurance information at your fingertips, eliminating the worry of forgetting or losing a physical document. Also, changes to your insurance policy, such as a new vehicle or a change in coverage, require updates to your insurance card. With a template, these updates can be made swiftly and efficiently, ensuring that your insurance card always reflects your current coverage details.

The most significant benefit is that our template includes all legally required information for your region. This ensures that you always comply with local laws regarding proof of insurance, which prevents legal issues or fines for not carrying proper insurance documentation.

How to Edit Our Insurance Card Template PDF?

Editing our free insurance card template is simple and can be completed in just a few minutes. By keeping this document up to date with policy changes, you will ensure compliance with state laws and be prepared for any situation where proof of insurance is required. Here's how to edit this card:

- Locate the field for the policy number on the template. Carefully type in your unique policy number as it appears on your insurance policy documents. This number is crucial for identification and verification purposes.

- Find the section designated for the policyholder's name. Input the name exactly as it appears on your insurance policy. If the insurance covers multiple drivers, use the name of the primary policyholder.

- Scroll to the vehicle information section. Here, you must enter details such as the make, model, and year of your vehicle and the VIN. Ensure accuracy, as this information links the insurance coverage to your vehicle.

- Identify the fields for the policy effective dates, including your coverage's start and expiration dates. Input these dates carefully to reflect the current term of your insurance policy.

- Look for the section on the template where the insurance company's contact information goes. Fill in the insurer's name, customer service phone number, and any other relevant contact details provided in your policy documents.

- Review the entire card for accuracy once all the necessary fields are filled in. Confirm that all information matches your official documents and that there are no typos or errors.

- After ensuring all information is correct, save the document using a clear and descriptive file name. For easy identification, include the vehicle's make and model and the word "insurance").

- Decide if you need a physical copy of the insurance card. If so, print it and keep it in your car. Alternatively, save a digital copy on your smartphone or another device.

Your auto insurance card is a crucial element of responsible vehicle ownership and operation, whether kept as a physical copy in your vehicle or stored digitally for convenience.

Related Posts:

Check out the following links for in-depth guides and insights to help you stay informed and ensure you have all the necessary paperwork for your auto insurance needs:

- The Basics of SR-22 Insurance Certificates

- Top High-Risk Auto Insurance Providers

- Insurance Claims for Hit and Run Accidents

- Dealing with Auto Insurance after a Natural Disaster

- What Is Accident Forgiveness Insurance Coverage?

- Types of Telematics Auto Insurance

- What Is Gap Insurance and How Does It Work?

- Rental Car Insurance: Do You Really Need It?

- How Your Job and Lifestyle Affect Auto Insurance Rates

- Insurance for Teen Drivers: What Parents Need to Know

- What to Do After a Car Accident: A Legal Perspective

- How to Maximize Your Auto Insurance Discounts

- How to Lower Car Insurance Premiums?

- How to Appeal a Denied Auto Insurance Claim

- The Process of Determining Fault in Auto Insurance Claims

- The Role of Auto Insurance in Personal Injury Claims

- Underinsured vs. Uninsured Motorist Coverage: What's the Difference?

- How Do Traffic Tickets Affect Your Car Insurance Rates?

- The Legal Consequences of Driving Without Insurance

- State-by-State Guide to Minimum Auto Insurance Requirements

- Liability vs. Full Coverage: Making the Right Choice for You

- Auto Insurance Coverage: A Comprehensive Guide

- Understanding FR-44 Insurance Requirements